At Khadijah International Waqf (L) Foundation (KIWF), our governance is built on trust, transparency, and accountability, ensuring that every waqf contribution is preserved, grown, and distributed in a way that benefits the ummah now and for generations to come.

At Khadijah International Waqf (L) Foundation (KIWF), our governance is built on trust, transparency, and accountability, ensuring that every waqf contribution is preserved, grown, and distributed in a way that benefits the ummah now and for generations to come.

Our Waqf Model

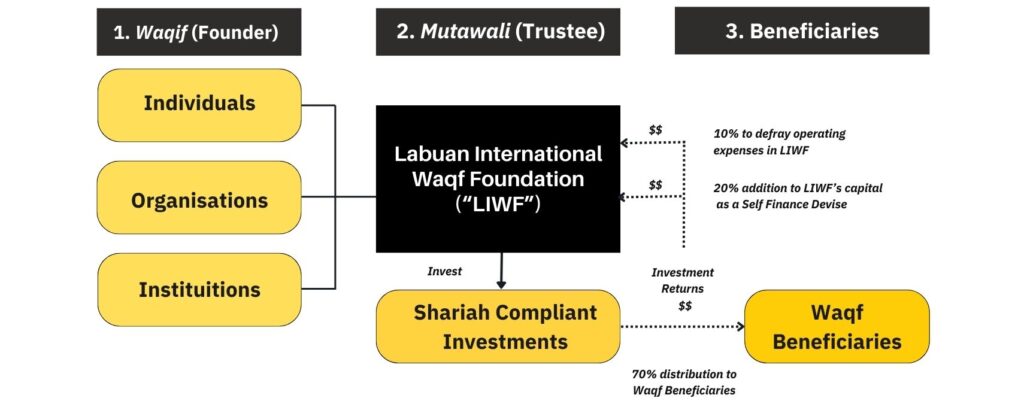

We operate on a three-role structure:

Waqif (Founder) – Individuals, organisations, and institutions who contribute assets (cash, property, equities, or other valuables) as waqf.

Mutawalli (Trustee) – KIWF acts as the Trustee, managing waqf funds in line with Shariah principles through low-risk Islamic investments and social impact projects.

Beneficiaries – Needy women, children, families, disabled individuals, and underprivileged elders.

Waqif (Founder) – Individuals, organisations, and institutions who contribute assets (cash, property, equities, or other valuables) as waqf.

Mutawalli (Trustee) – KIWF acts as the Trustee, managing waqf funds in line with Shariah principles through low-risk Islamic investments and social impact projects.

Beneficiaries – Needy women, children, families, disabled individuals, and underprivileged elders.

How it works:

Waqf assets are invested in Shariah-compliant, low-risk opportunities.

Returns are distributed with a 70:20:10 allocation:

70% to beneficiaries

20% reinvested into KIWF’s capital for sustainability

10% for operational costs

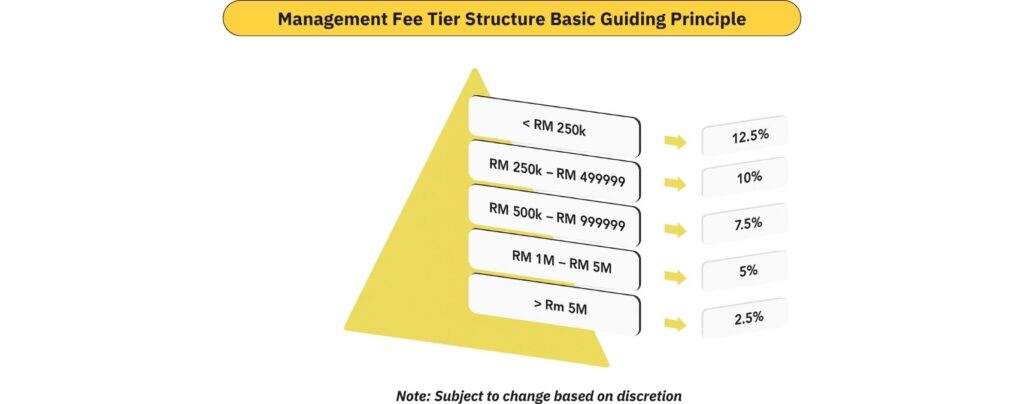

A tiered management fee ensures efficiency and scalability.

Oversight & Safeguards

1) Fiduciary Duty:

Our Foundation has a fiduciary responsibility to:

- Preserve, protect, and develop waqf property

- Maximise benefits for beneficiaries

- Honour the conditions set by the Waqifs

- Comply with our Waqfiyyah (Charter) and legal provisions

2) Oversight Mechanisms:

- Shariah Advisers – Conduct annual Shariah compliance review/audit to ensure all activities and investments adhere to Shariah principles, including waqf principles.

- Supervisory Officers – Ensure the foundation’s objectives are fulfilled according to the charter and law.

- Auditors – Perform annual audits of financial records and statements.

3) Transparency Commitment:

We report to Labuan Financial Services Authority (LFSA) and ensure transparency to all Waqifs by publishing:

- Amounts collected

- Investment allocations

- Distribution reports

4) Accountability:

“Line of reporting for KIWF to LFSA will be as transparent as we can to all waqifs by posting relevant amounts collected and where invested and distributed. Finally accountability to Allah SWT as we are established to gain pleasure of Allah SWT.”

Governance & Compliance

Our 5 Waqf Pillars

KIWF’s work is guided by five strategic pillars — each aligned with both Maqasid Shariah and contemporary social needs:

Health & Wellness

Education & Learning

Economic Empowerment

Humanitarian Relief

Innovation & Scientific Development

Join Sahabat Khadijah

Together, We Serve with Heart